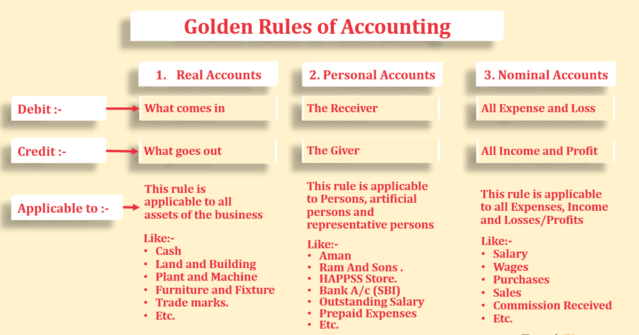

According to the basic laws of accounting, whenever any transaction takes place, an account is either debited or credited. The principle of book-keeping lies in finding out which accounts are to be debited and which account accounts are to be credited. There are three fundamentals rules for recording the transactions.

First rules state:

Debit the receiver and credit the giver. Let us understand the rule by means of an example. Suppose Ram buys goods from Sita. Here Ram has received the goods and Sita has given the goods. Ram is, therefore, obligated to pay the price of the goods. Sita is entitled to a credit because he has given the goods. In accounting lingo, Ram will be debited and Sita will be credited. Later on, when Ram pays to Sita, Sita will be under obligation on account of receipt of money from Ram, therefore Sita's account will have to be debited and Ram's account has to be credited.

Second rule states:

Debit what comes in and credit what goes out. Let us understand the rules by means of an example. Suppose you buy furniture for your office on cash. Then according to this rule, the furniture account will be debited (as the furniture comes in) and the cash account will be credited (as cash goes out).

Third rules state:

Debit all expenses/ losses and credit all income/gains. Let us understand the rules by means of an example. Suppose you have hired a building for your office and pay the monthly rent to the landlord, then according to this rule, you will have to debit the rent account and credit the cash account.

Based on the above three rules, you always debit or credit an account. After the accounts are prepared, the net results of debits and credits of each account are assessed. If the debits are more, the balance is known as debit balance and if credits are more, the balance is known as a credit balance. A debit balance indicates that either the company owes money to an outsider or the company owes assets totaling the relevant amount or the company has incurred losses equivalent to debit balance. On the other hand, a credit balance indicates that an outsider has to pay the company or the company has earned an income equivalent to the credit balance.

First rules state:

Debit the receiver and credit the giver. Let us understand the rule by means of an example. Suppose Ram buys goods from Sita. Here Ram has received the goods and Sita has given the goods. Ram is, therefore, obligated to pay the price of the goods. Sita is entitled to a credit because he has given the goods. In accounting lingo, Ram will be debited and Sita will be credited. Later on, when Ram pays to Sita, Sita will be under obligation on account of receipt of money from Ram, therefore Sita's account will have to be debited and Ram's account has to be credited.

Second rule states:

Debit what comes in and credit what goes out. Let us understand the rules by means of an example. Suppose you buy furniture for your office on cash. Then according to this rule, the furniture account will be debited (as the furniture comes in) and the cash account will be credited (as cash goes out).

Third rules state:

Debit all expenses/ losses and credit all income/gains. Let us understand the rules by means of an example. Suppose you have hired a building for your office and pay the monthly rent to the landlord, then according to this rule, you will have to debit the rent account and credit the cash account.

Based on the above three rules, you always debit or credit an account. After the accounts are prepared, the net results of debits and credits of each account are assessed. If the debits are more, the balance is known as debit balance and if credits are more, the balance is known as a credit balance. A debit balance indicates that either the company owes money to an outsider or the company owes assets totaling the relevant amount or the company has incurred losses equivalent to debit balance. On the other hand, a credit balance indicates that an outsider has to pay the company or the company has earned an income equivalent to the credit balance.